How to Accept Stablecoin Payments: A Complete Guide for Businesses in 2025

Learn how to accept stablecoin payments like USDC and USDT for your business. Reduce fees, speed up settlements, and reach global customers without the complexity of traditional payment processors.

If you’re a business owner tired of watching credit card fees eat into your margins, or waiting days for international wire transfers to clear, there’s good news: stablecoin payments are going mainstream, and accepting them is easier than you might think.

In this guide, we’ll walk you through everything you need to know about accepting stablecoin payments—no technical background required.

What Are Stablecoins?

Stablecoins are digital currencies designed to maintain a stable value, typically pegged 1:1 to the US dollar. Unlike Bitcoin or Ethereum, which can swing 10% in a single day, stablecoins like USDC and USDT stay steady at approximately $1.00.

Think of them as digital dollars that can move across the internet instantly, 24/7, without banks or payment processors in the middle.

The two most popular stablecoins are:

- USDC (USD Coin) — Issued by Circle, fully backed by US dollar reserves

- USDT (Tether) — The largest stablecoin by market cap

Together, USDC and USDT represent over 90% of the stablecoin market.

Why Businesses Are Making the Switch

The Numbers Tell the Story

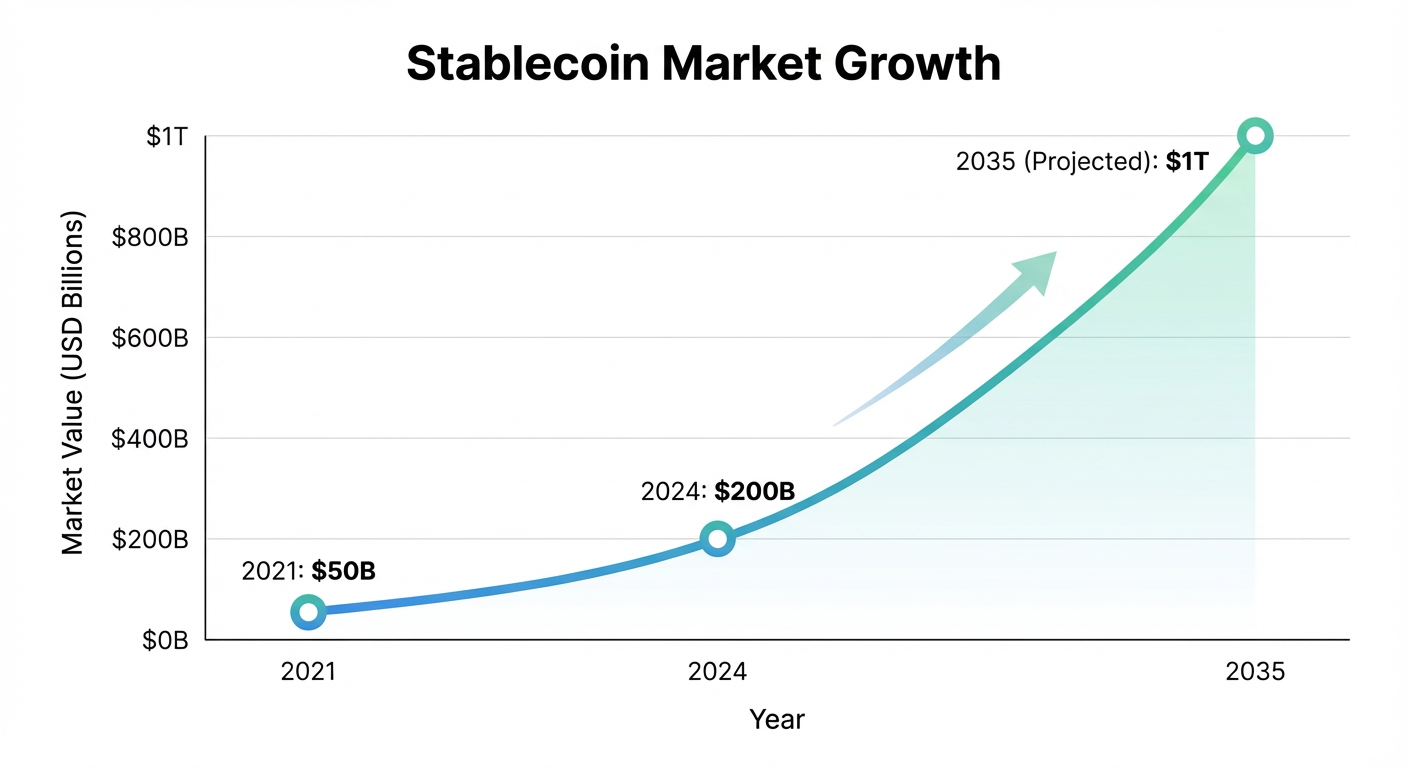

The stablecoin market is experiencing explosive growth:

- Total stablecoin market cap crossed $200 billion for the first time in December 2024

- The market is projected to reach $1 trillion by 2035, growing at 17.96% annually

- Major companies like Visa are piloting stablecoin payouts for creators and gig workers

This isn’t a niche technology anymore—it’s becoming a standard payment option for forward-thinking businesses.

Escape the Credit Card Fee Trap

Let’s talk about what traditional payments really cost you.

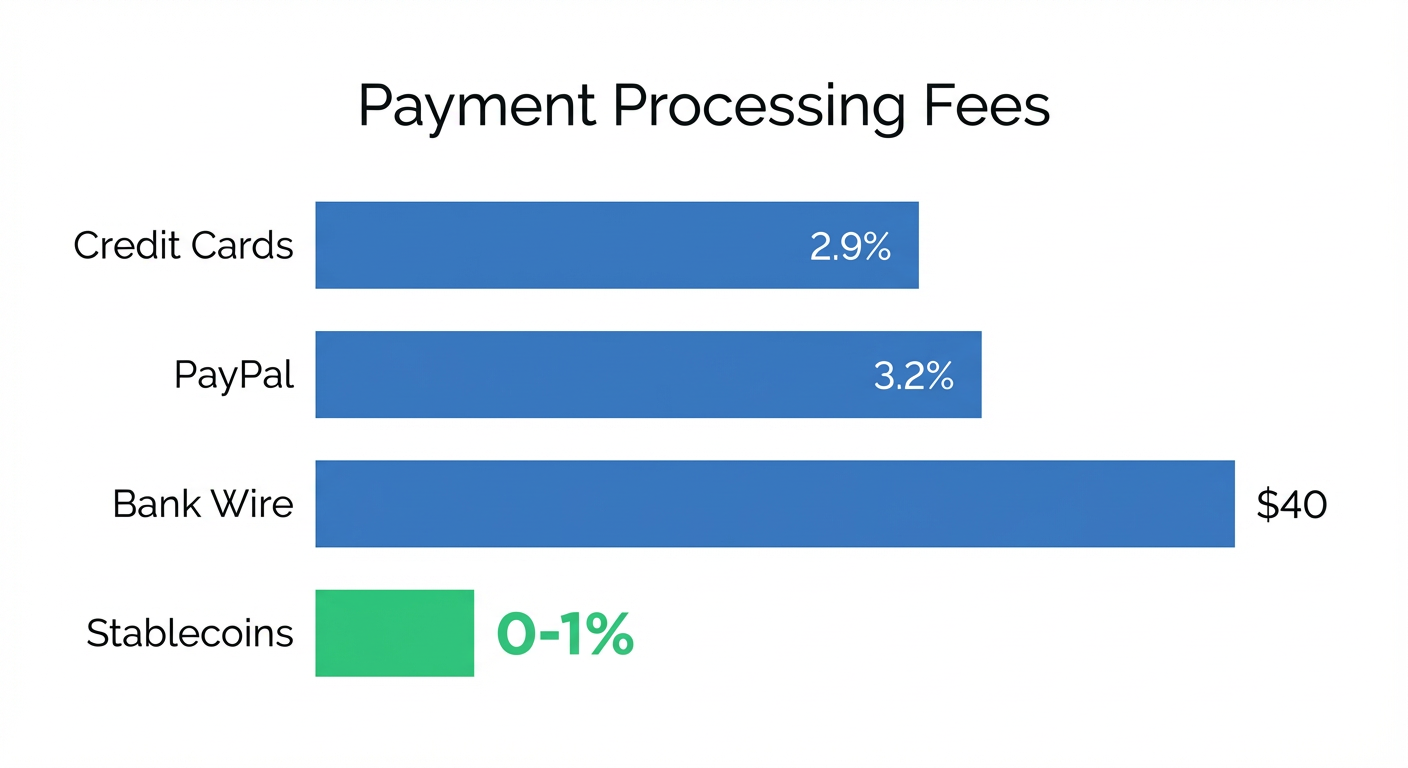

According to industry data, the average credit card processing fee in 2024 was 2.24% to 2.4% per transaction. For e-commerce businesses, it’s even higher—averaging 2.5% to 3.0% due to fraud and chargeback risks.

That means if you process $100,000 in sales, you’re handing over $2,500 to $3,000 just in processing fees.

With stablecoins? Many platforms charge 0.1% to 1%—or in the case of some providers like PayIn, zero fees entirely.

Faster Global Payments

If you work with international customers or suppliers, you know the pain:

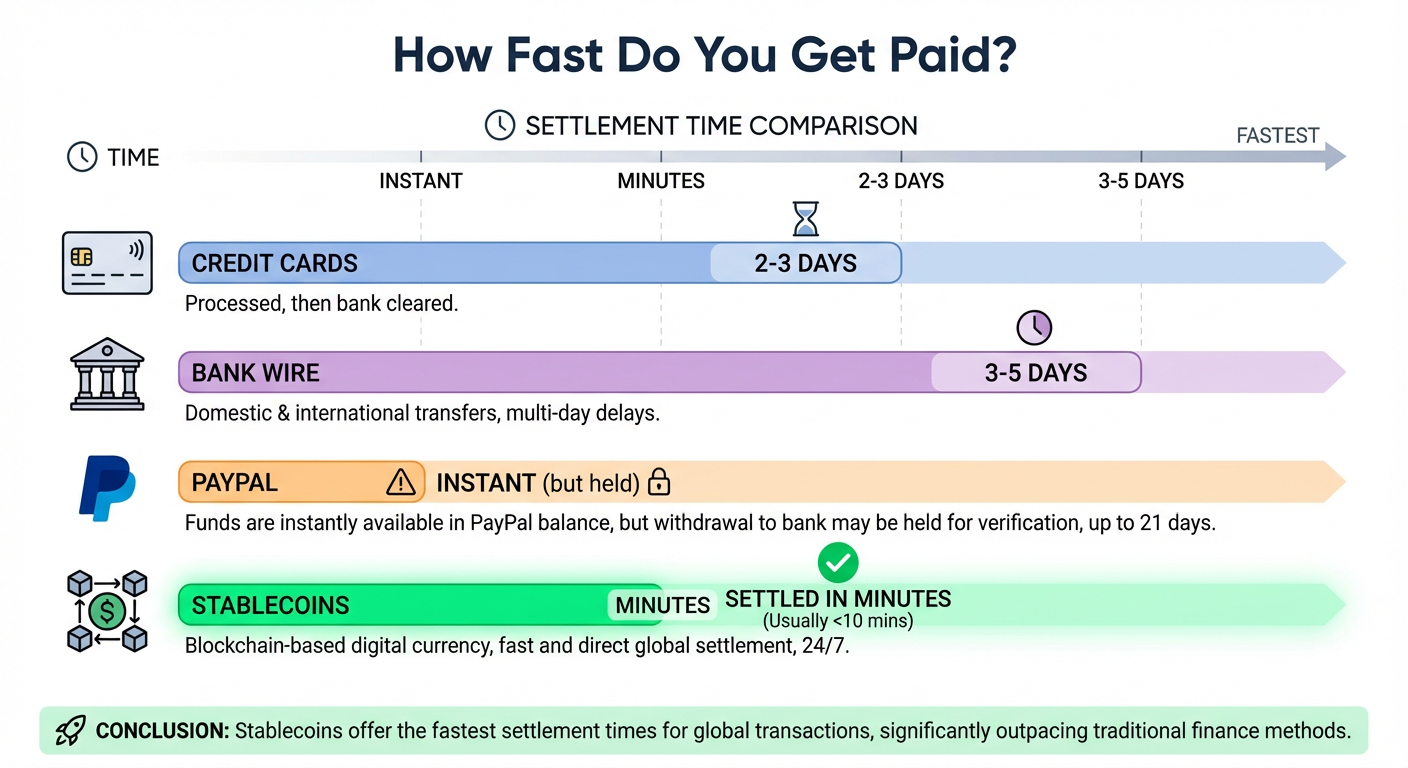

- Traditional wire transfers take 2-5 business days

- Fees can include $25-$50 per transfer plus 1-4% in hidden exchange rate markups

- According to a recent survey, 55% of mid-market businesses lose 4-5% of revenue monthly due to payment inefficiencies

Stablecoin payments settle in minutes, not days. And since stablecoins are already denominated in dollars, there’s no currency conversion needed.

No Chargebacks

Unlike credit card payments, stablecoin transactions are final. Once a customer pays, the money is yours. No chargebacks, no disputes, no payment reversals months later.

For businesses that have dealt with fraudulent chargebacks, this alone can be a game-changer.

Payment Methods Compared: At a Glance

Here’s how stablecoin payments stack up against traditional options:

| Feature | Credit Cards | Bank Wire | PayPal | Stablecoins |

|---|---|---|---|---|

| Transaction Fee | 2.4% - 3.5% | $25 - $50 + FX markup | 2.9% + $0.30 | 0% - 1% |

| Settlement Time | 2-3 days | 2-5 days | Instant (held) | Minutes |

| International | Extra fees | Expensive & slow | 4.4% + FX fee | Same as domestic |

| Chargebacks | Yes (risk) | No | Yes (risk) | No |

| Weekend/Holiday | Delayed | No processing | Delayed | 24/7/365 |

| Account Freeze Risk | Possible | Possible | Common | None (non-custodial) |

| Minimum Payout | Often $25+ | Often $100+ | $1 | None |

| Setup Requirements | Application, approval | Bank account | Account verification | Wallet only |

The Real Cost on $10,000 Monthly Revenue

Let’s do the math for a business processing $10,000 per month:

| Payment Method | Monthly Fees | Annual Cost |

|---|---|---|

| Credit Cards (2.9%) | $290 | $3,480 |

| PayPal (2.9% + $0.30/tx) | $320+ | $3,840+ |

| Bank Wires (avg 3 intl.) | $150+ | $1,800+ |

| Stablecoins (PayIn) | $0 | $0 |

That’s potentially $3,000+ saved annually—money that goes back into your business instead of payment processors.

How to Start Accepting Stablecoin Payments

You don’t need to be a crypto expert or hire blockchain developers. Here are your options:

Option 1: Payment Links (Easiest)

The simplest way to get started is with payment links—shareable URLs that customers can use to pay you in stablecoins.

Services like PayIn let you create a payment link in 30 seconds. Share it via email, embed it on your website, or include it in invoices. When a customer pays, the funds go directly to your wallet.

Best for: Freelancers, consultants, small businesses, one-time invoices

Option 2: Deposit Addresses (For Recurring Customers)

If you have customers who pay regularly—like subscribers, gamers, or platform users—you can assign them a permanent deposit address. Every time they send funds to that address, you’re automatically notified.

Best for: Gaming platforms, membership sites, SaaS with recurring billing

Option 3: API Integration (For Developers)

Larger businesses can integrate stablecoin payments directly into their checkout flow using APIs. This provides the most seamless experience for customers but requires some development work.

Best for: E-commerce stores, marketplaces, payment platforms

Choosing the Right Stablecoin Payment Provider

Not all payment providers are created equal. Here’s what to look for:

Custodial vs. Non-Custodial

Custodial providers hold your funds for you—similar to a bank account. This is convenient but comes with risk: if the provider gets hacked or goes bankrupt, you could lose your money.

Non-custodial providers send funds directly to your own wallet. You maintain full control at all times. There’s no intermediary that can freeze your account or disappear with your funds.

For most businesses, non-custodial is the safer choice.

Multi-Chain Support

Stablecoins exist on multiple blockchains:

- Ethereum — The original, but higher transaction fees

- Polygon — Lower fees, growing adoption

- Solana — Very fast and cheap transactions

- Tron — Popular in Asia and for larger transfers

A good provider should support multiple chains so you can accept payments from customers regardless of which blockchain they prefer.

Fees and Pricing

Some providers charge per-transaction fees, monthly subscriptions, or withdrawal fees. Others, like PayIn, offer completely free services with no hidden costs.

Always understand the total cost before committing.

Getting Your First Stablecoin Wallet

Before you can accept payments, you’ll need a wallet to receive them. Here’s a simple approach:

- Download a wallet app like MetaMask (for Ethereum/Polygon), Phantom (for Solana), or a multi-chain wallet like Trust Wallet

- Write down your recovery phrase — This is a 12 or 24-word backup that lets you recover your wallet. Keep it safe and never share it.

- Get your wallet address — This is like your account number. Share it with customers or use it with your payment provider.

That’s it. You now have a wallet that can receive USDC, USDT, and other stablecoins.

Real-World Use Cases

Freelancers and Agencies

Accept international client payments without wire transfer fees or currency conversion. Get paid in USDC and either hold it as dollars or convert to your local currency.

E-Commerce

Offer stablecoin checkout as an alternative to credit cards. Appeal to crypto-native customers while avoiding chargebacks on high-ticket items.

Gaming and Digital Goods

Let players deposit funds for in-game purchases. Stablecoins are perfect for microtransactions where credit card fees would eat into margins.

B2B and Wholesale

Speed up payment terms with suppliers. Instead of Net-30 with traditional invoicing, offer a discount for immediate stablecoin payment.

Subscription Services

Automate recurring payments with deposit addresses. Customers fund their account, and you deduct fees as they use your service.

Common Questions

”Is this legal?”

Yes. Stablecoins are legal to use for payments in most countries. However, tax laws still apply—you’ll need to report income just like any other payment method. Consult with your accountant for specifics in your jurisdiction.

”What about volatility?”

That’s the point of stablecoins—they don’t have the volatility of Bitcoin or Ethereum. USDC and USDT are designed to stay at $1.00. Minor fluctuations (±0.1%) can occur but are negligible for business purposes.

”Can I convert to regular dollars?”

Absolutely. You can convert stablecoins to USD through cryptocurrency exchanges like Coinbase, Kraken, or Circle. Many businesses keep a portion in stablecoins (for fast payments) and convert the rest to traditional currency.

”What if customers don’t have crypto?”

Customers can purchase stablecoins easily through apps like Coinbase, PayPal, or directly with a credit card on many platforms. The barrier to entry is lower than ever.

Getting Started Today

Accepting stablecoin payments doesn’t require a complete overhaul of your business. Start small:

- Set up a wallet (10 minutes)

- Create a payment link with a service like PayIn (30 seconds)

- Offer it as an option to customers who prefer crypto payments

- Scale up as you see demand

The businesses that adopt stablecoin payments now will have a significant advantage as this technology becomes mainstream. Lower fees, faster settlements, and global reach—without the complexity of traditional payment processors.

The future of payments is already here. The only question is whether you’ll be ready for it.

Ready to accept stablecoin payments? PayIn offers free, non-custodial payment processing for USDC, USDT, and more across Ethereum, Polygon, Solana, and Tron. Create your first payment link in 30 seconds.