Already Accept Bitcoin? Here's Why You Should Add USDC

If your business accepts Bitcoin, adding USDC stablecoin payments solves the volatility problem while keeping crypto's benefits. Learn how to upgrade your payment options in minutes.

You already accept Bitcoin. You understand the benefits: no chargebacks, lower fees than credit cards, global reach, and customers who appreciate the option.

But you’ve also experienced the challenges.

A customer pays $500 in BTC. By the time you convert it, market volatility means you’re holding $470. Or $530. You never know which.

What if you could keep everything you love about crypto payments—while eliminating the volatility?

That’s exactly what adding USDC does.

The Volatility Problem (That You Already Know)

Bitcoin merchants understand this scenario too well:

| Day | BTC Price | Customer Pays | You Receive |

|---|---|---|---|

| Monday | $42,000 | 0.0119 BTC ($500) | — |

| Tuesday | $40,500 | — | $481.95 |

| Difference | — | — | -$18.05 (-3.6%) |

Sometimes the swing goes in your favor. Sometimes it doesn’t. Either way, it’s unpredictable—and that makes accounting, pricing, and cash flow management harder than it needs to be.

Why Volatility Matters More for Some Businesses

If you’re a coffee shop, a 3% variance might be acceptable as a customer acquisition cost.

But if you’re:

- A service provider with thin margins

- A vacation rental with weeks between booking and checkout

- A B2B vendor invoicing for large amounts

- A subscription business with recurring payments

…that volatility compounds into real money.

Enter Stablecoins: Same Benefits, No Rollercoaster

USDC (USD Coin) is a dollar-pegged stablecoin issued by Circle. Its value stays at $1.00—not approximately, but precisely. It’s backed 1:1 by US dollar reserves and audited monthly.

Here’s what that means for your business:

| Feature | Bitcoin | USDC |

|---|---|---|

| Price stability | ±5-15% daily swings possible | Pegged to $1.00 |

| Settlement finality | 10-60 min (confirmations) | Seconds |

| Predictable cash flow | No | Yes |

| Easy accounting | Requires conversion tracking | Dollar-denominated |

| Customer volatility risk | Yes | No |

You’re not replacing Bitcoin—you’re adding a stable option.

Customers who want to spend BTC still can. But customers who prefer stability (or businesses that require it) now have a choice.

Why Your Bitcoin Customers Will Appreciate USDC

Here’s something counterintuitive: many of your Bitcoin customers actually want a stablecoin option.

Reason 1: They Don’t Want to Spend Appreciating Assets

Bitcoin believers often prefer to hold BTC as a store of value. Spending it feels like selling a potential future gain. USDC, on the other hand, is meant to be spent—it doesn’t appreciate.

Reason 2: They Already Have Stablecoins

Anyone active in crypto likely holds stablecoins for:

- DeFi activities

- Trading pairs

- Yield farming

- Holding dry powder for market dips

These customers have USDC ready to spend and prefer using it over selling BTC.

Reason 3: Exact Amounts Without Math

With BTC, paying exactly $127.43 requires calculating satoshis at current exchange rates. With USDC, it’s just… $127.43.

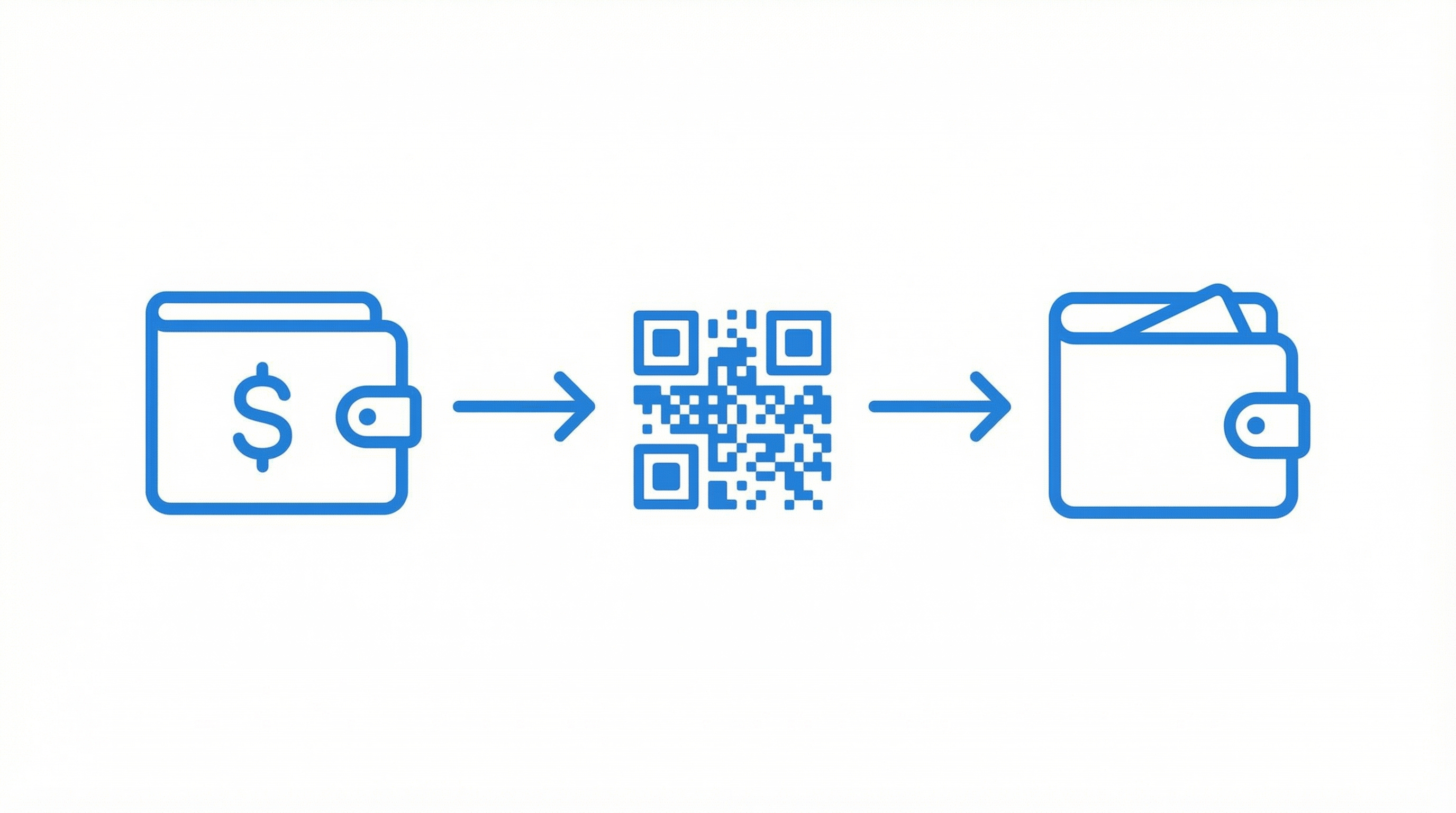

How to Add USDC with PayinGo

If you’re already accepting Bitcoin, you likely have a crypto wallet. Adding USDC takes about 30 seconds:

Step 1: Get Your Wallet Address

You need an address on a network that supports USDC. The most common options:

| Network | Address Format | Transaction Time | Typical Fee |

|---|---|---|---|

| Base | 0x… (EVM) | ~2 seconds | < $0.01 |

| Polygon | 0x… (EVM) | ~2 seconds | < $0.01 |

| Solana | Base58 string | ~1 second | < $0.01 |

If you have a MetaMask or Coinbase Wallet, you already have an EVM address that works on Base and Polygon. If you use Phantom, you’re set for Solana.

Step 2: Create a Payment Link

- Go to go.payin.com

- Enter your wallet address

- Enter your business name

- Click Create

You now have a payment link that accepts USDC. Customers scan the QR code or click the link, connect their wallet, and pay. Funds arrive in your wallet in seconds—no conversion, no volatility, no middleman.

Step 3: Add It Alongside Your Bitcoin Option

You don’t need to change your existing Bitcoin setup. Simply add the new USDC option:

Before:

We accept Bitcoin: [BTC address]

After:

We accept:

- Bitcoin: [BTC address]

- USDC (gasless): [PayinGo link]

Step 4: Test It Yourself

Before going live, verify the flow:

- Open your payment link

- Scan the QR with your wallet

- Send a small amount (even $0.01)

- Confirm it arrives in your wallet

With PayinGo, you can test by paying to yourself—the receiving wallet can be the same as the sending wallet.

The PayinGo Advantage for Bitcoin Merchants

PayinGo is specifically designed for merchants who want simple, direct crypto payments:

Gasless for Customers

Unlike Bitcoin (where customers pay network fees), PayinGo covers all transaction costs. Your customers pay exactly the amount shown—no extra fees tacked on.

No Account Required

Just like Bitcoin, there’s no KYC, no signup, no monthly fees. Create a link, share it, receive payments.

Non-Custodial

Funds go directly to your wallet. PayinGo never holds your money. This is the same self-custody model you appreciate with Bitcoin.

POS Mode for Retail

If you accept Bitcoin in-store, PayinGo’s POS mode gives you:

- Real-time payment confirmation on screen

- Sound notifications when payment arrives

- QR code display for customer scanning

- Works on any tablet or phone

Multiple Networks, One Link

Accept USDC on Base, Polygon, and Solana with a single payment link. Customers choose their preferred network.

Common Questions from Bitcoin Merchants

”Does this mean I’m abandoning Bitcoin?”

Not at all. You’re expanding your options. Many merchants accept both credit cards and PayPal—this is the same concept. Bitcoin for those who prefer it, USDC for those who want stability.

”What about Lightning Network?”

Lightning solves Bitcoin’s speed problem but not the volatility problem. A Lightning payment still fluctuates in value between receipt and conversion. USDC is dollar-stable from the moment it arrives.

”How do I convert USDC to dollars?”

You can:

- Hold USDC — It’s dollar-denominated, so there’s no urgency to convert

- Use an exchange — Coinbase, Kraken, and others offer easy USDC-to-USD conversion

- Spend USDC directly — Increasing numbers of vendors accept it

Many merchants keep a portion in USDC for fast crypto payments and convert the rest as needed.

”What about USDT?”

USDT (Tether) is the other major stablecoin. PayinGo currently focuses on USDC because:

- It’s fully backed by US dollar reserves

- Monthly attestation reports from major accounting firms

- Native support for gasless transfers (ERC-3009)

- Growing institutional adoption

Both work, but USDC has stronger transparency and compliance credentials.

”Is this legal?”

Yes. Stablecoins are legal to accept as payment in most jurisdictions. You’ll report the income for tax purposes just like any other payment method.

Real-World Hybrid Setup

Here’s how a typical Bitcoin merchant might structure their payment options:

| Payment Method | Best For | Fee to You |

|---|---|---|

| Bitcoin (on-chain) | Large purchases, store of value customers | Network fee (~$1-5) |

| Bitcoin (Lightning) | Small purchases, fast settlement | Minimal |

| USDC (PayinGo) | Any amount, volatility-averse customers | Free |

You’re not choosing between them—you’re offering each for its ideal use case.

The Bottom Line

Adding USDC to your Bitcoin payments gives you:

- Price stability — $100 received = $100 in your wallet

- Faster settlement — Seconds, not minutes

- Simpler accounting — Dollar-denominated from the start

- Broader appeal — Capture customers who prefer stability

- Same self-custody — Non-custodial, just like Bitcoin

You already did the hard part: adopting crypto payments. Adding USDC is the natural next step.

Ready to add USDC? Create a free, gasless payment link at go.payin.com in 30 seconds. Works alongside your existing Bitcoin setup.